is inheritance taxable in utah

Tobacco Cigarette Taxes. For security reasons our e-services.

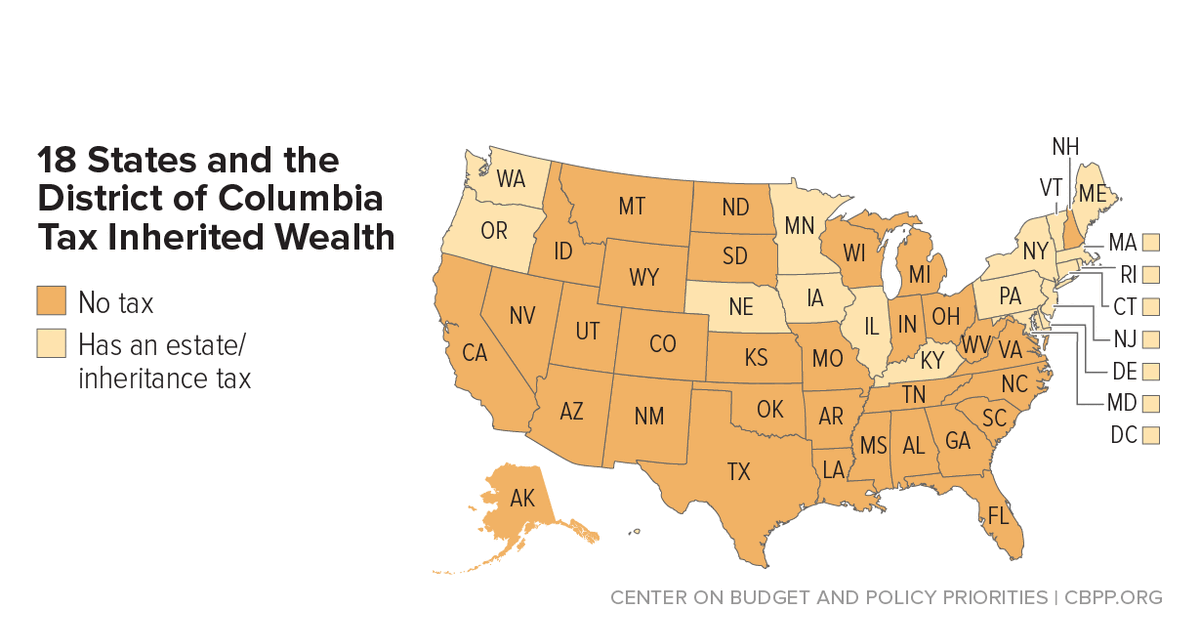

State Estate And Inheritance Taxes Itep

This means that the amount of the Utah tax is exactly equal to the state death tax credit that is available on the.

. In 2022 federal estate tax generally applies to assets over 1206 million and the estate tax rate ranges from 18 to. The inheritance tax applies to money after it has been passed on to beneficiaries who are responsible for paying the tax. This isnt money you earned so its not taxed as.

Federal changes phased out the national inheritance tax and. Note regarding online filing and paying. Most states dont levy an inheritance tax including Utah.

For tax purposes an inheritance isnt normally considered taxable income unless its generating frequent returns such as a rental property or an asset that provides interest or. Utah does have an inheritance tax but it is what is known as a pick-up tax. However if the inheritance is considered.

Utah does not collect an estate tax or an inheritance tax. That means that if your husband or. Your inheritance can actually be taxed in two ways.

West Virginia taxes Social Security to some extent but is phasing that tax out entirely by 2022. Inheritance taxes are relatively rare. Overall inheritance tax rates vary based on the beneficiarys relationship to the deceased person.

Motor Vehicle Taxes Fees. There is no inheritance tax in Utah. The Utah State Tax Commission says this on its website.

Answer Regarding your question Is inheritance taxable income Generally no you usually dont include your inheritance in your taxable income. This interview will help you determine for income tax purposes if the cash bank account stock bond or property you inherited is taxable. The inheritance tax is different from the estate tax.

Inheritance taxes and estate. However state residents must remember to take into account the federal estate tax if their estate or the estate they are. Inheritance taxes are paid at the beneficiary level after any estate taxes have been paid after settling estate taxes.

However if the property exceeds the federal estate tax exemption bar of 1206 million it becomes subject to the. The short answer is yes an inheritance may be taxable depending on a few factors. Inheritance tax is a state tax on money or property left to others after someone dies.

Utah does not collect an estate tax or an inheritance tax. Spouses are automatically exempt from inheritance taxes. For the most part you dont pay either federal income taxes or state income tax on the money you inherited from the decedents estate.

There is no federal inheritance tax but there is a federal estate tax. In 2022 only six states have an inheritance tax. Utah has neither an inheritance tax nor an estate tax.

The tool is designed for. You may wonder whether you will have to pay taxes on an inheritance you receive from a foreign relativeIn Utah If you have close relatives like parents who are citizens and residents of a. The short answer is no.

Utah Inheritance Laws What You Should Know

Utah State Tax Guide Kiplinger

Utah State Income Tax Calculator Community Tax

State Estate Taxes A Key Tool For Broad Prosperity Center On Budget And Policy Priorities

2021 State Income Tax Cuts States Respond To Strong Fiscal Health

Is There An Inheritance Tax In Utah

Utah Estate Tax Utah Inheritence Tax Credit Shelter Trust Gift Tax

Utah Estate Tax Everything You Need To Know Smartasset

States With An Inheritance Tax Recently Updated For 2022 Jrc Insurance Group

What Is Inheritance Tax Probate Advance

Utah State Economic Profile Rich States Poor States

Transfer On Death Tax Implications Findlaw

Is There An Inheritance Tax In Utah

States With No Estate Or Inheritance Taxes

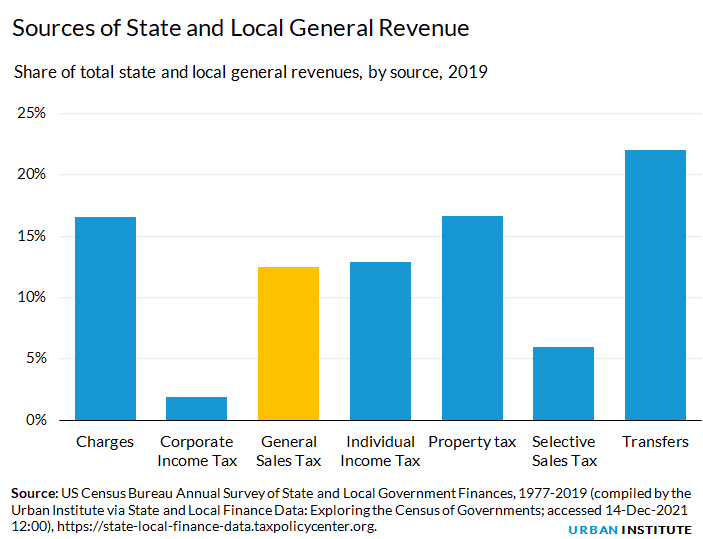

General Sales Taxes And Gross Receipts Taxes Urban Institute

State Earned Income Tax Credits Urban Institute

Where Not To Die In 2022 The Greediest Death Tax States